We all want a life of peace and security, right? But sometimes, figuring out how to manage our money feels like trying to solve a puzzle with half the pieces missing.

I get it. For years, my own financial situation felt like a reflection of other areas in my life – chaotic and driven by impulse. I’d chase quick fixes, whether it was the instant gratification of gaming, overeating, or just letting laziness win the day. It took a lot of hard work to find balance, to transform my habits and my body. I lost over 110 pounds by focusing on small, consistent actions and a long-term vision. The truth is, managing your money wisely demands the same kind of steady effort, self-awareness, and purposeful action. It’s not about getting rich overnight. It's about building a strong foundation, piece by piece, so you can live a good existence now and in the future.

Let’s talk about how we can approach asset allocation not as some complicated financial jargon, but as a practical path to peace of mind. Here are 10 steps to help you allocate your assets wisely, just like you would build a healthy, sustainable life.

1. Know Your “Why”

Before you move a single dollar, ask yourself: Why am I doing this? What are my biggest dreams? Is it saving for a down payment, an education, or a comfortable retirement? Maybe you want to have enough to give generously to your community or church. When I started my journey to a healthier lifestyle, I had a clear “why” – I wanted to feel good, have more energy, and live fully. Without that strong purpose, I would have given up. Your financial “why” acts as your compass. Write it down. Make it real.

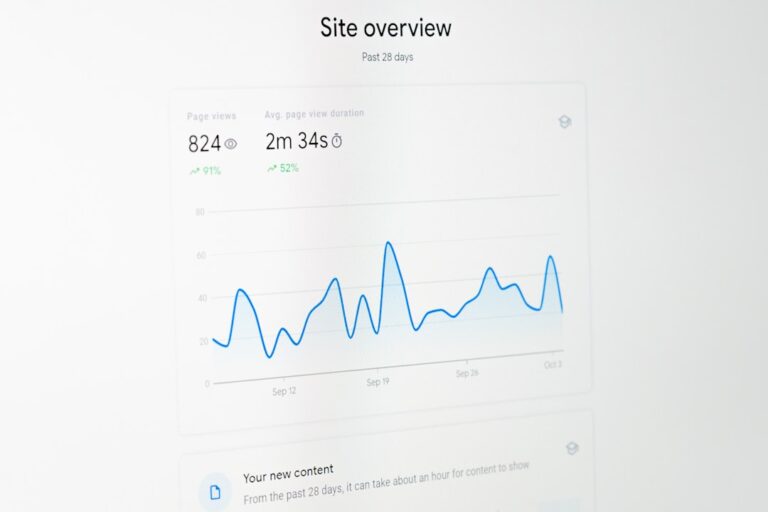

2. Understand Your Current Financial Picture

You can’t plan a trip without knowing where you are starting from. Gather all your financial information. What do you own (assets like savings, investments, property)? What do you owe (debts like loans, credit card balances)? Look at your income and your expenses. Creating a simple net worth statement and tracking your spending for a month or two gives you a clear snapshot. It might be uncomfortable at first, but honesty is the first step to change.

3. Build Your Emergency Fund

This is non-negotiable. An emergency fund is your safety net for unexpected life events – a car repair, a medical bill, or job loss. Aim for at least three to six months of living expenses saved in an easily accessible, separate savings account. This fund keeps you from dipping into investments or going into debt when life throws a curveball. It’s your financial peace of mind.

4. Get Out of Bad Debt

High-interest debt, like credit card balances, can feel like a heavy chain around your ankle. It drains your resources and makes it incredibly hard to move forward. Make a plan to tackle this debt aggressively. Focus on paying off the highest interest debts first. Think of it as liberating your future income so it can work for you, not against you. Just like breaking an unhealthy habit, it takes discipline and focus, but the freedom you gain is immense.

5. Define Your Risk Tolerance

How comfortable are you with the ups and downs of the market? Are you someone who can sleep soundly if your investments drop in value for a bit, knowing they'll likely recover? Or does the thought of a dip make you anxious? Your risk tolerance will guide how much you invest in stocks (higher risk, higher potential return) versus bonds or cash (lower risk, lower return). There's no right or wrong answer, only what feels right for you.

6. Diversify Your Investments

This is a golden rule in investing: Don’t put all your eggs in one basket. Diversification means spreading your investments across different asset classes (stocks, bonds, real estate), industries, and geographic regions. If one area struggles, others might thrive, balancing your overall portfolio. It reduces your risk and gives you a smoother ride over the long term.

7. Automate Your Savings and Investments

Make it easy to do the right thing. Set up automatic transfers from your checking account to your savings and investment accounts each payday. This "set it and forget it" approach ensures you consistently contribute to your goals before you have a chance to spend the money. This strategy helped me when I was building a productive routine; automating certain tasks meant I didn’t rely on willpower alone. It builds momentum without constant effort.

8. Plan for the Long Term (and Rebalance)

Wise asset allocation is a marathon, not a sprint. Focus on long-term growth and avoid reacting to every market fluctuation. Review your portfolio at least once a year. Life changes, and so do your goals and risk tolerance. Rebalancing means adjusting your investments back to your desired allocation. For example, if stocks have done really well and now make up a larger portion of your portfolio than you intended, you might sell some stocks and buy more bonds to get back to your original plan. This helps you manage risk and stay aligned with your goals.

9. Protect Your Assets

It's not just about growing your money; it's about protecting what you have built. Think about adequate insurance – health, life, and disability. Consider estate planning documents like a will. These steps might not seem exciting, but they are crucial for safeguarding your financial future and providing for your loved ones, no matter what happens.

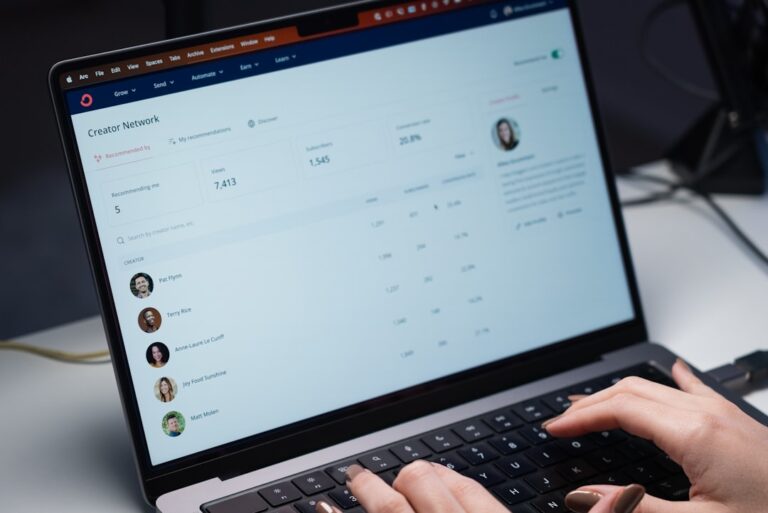

10. Educate Yourself Continuously

The financial world can seem complex, but you don't need a finance degree to make smart choices. Read reputable books, follow trusted financial blogs, and ask questions. The more you understand, the more confident you'll feel making decisions. Start small. Learn about index funds, compound interest, or the basics of budgeting. Every bit of knowledge builds on the last, empowering you to make even better choices for your future.

Allocating your assets wisely isn't just about numbers; it's about intentional living. It's about taking responsibility, planning for the future, and giving yourself the freedom to live a life aligned with your values.

What's one small step you can take today to move closer to your financial goals? Don’t wait for perfection. Just start.